ETFs are officially a more popular investment vehicle among financial advisors than mutual funds. At least, that’s what data from the more than 1,200 advisors who use Advyzon for performance reports shows.

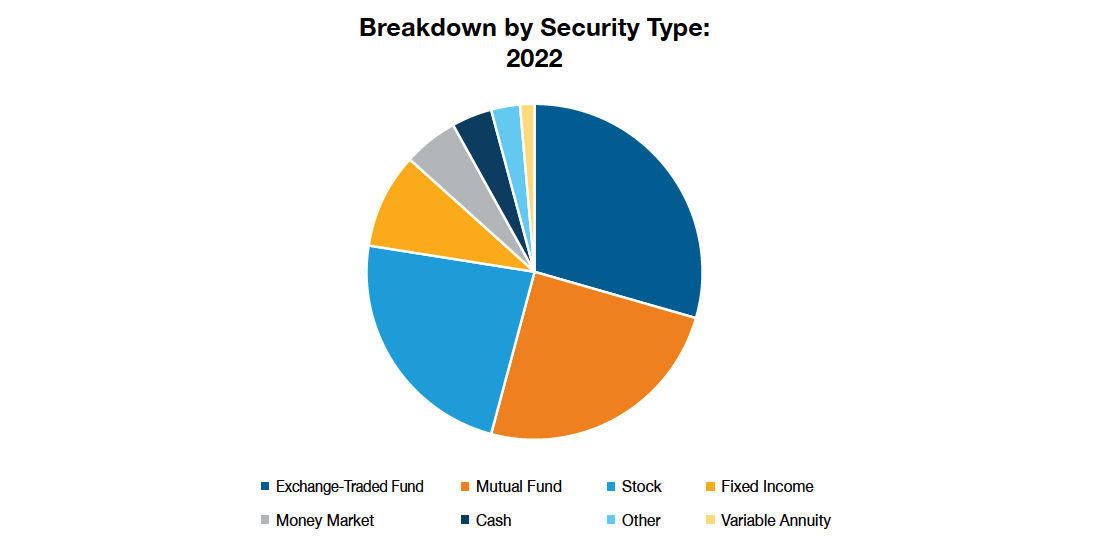

At the end of 2022, advisors had roughly 28.5% of client assets in ETFs. While that’s roughly the same level we saw at the close of 2021, the share of client assets in mutual funds decreased last year. Advisors had just under 24% of client money invested via mutual funds at the close of 2022, down from more than 30% at the close of 2021.

According to Advyzon Investment Management CIO Brian Huckstep, this is a trend 30 years in the making. “It started when State Street launched SPY as the first ETF in the U.S.,” he explained. “From the start, the tax benefits, liquidity, and relatively low cost made ETFs attractive to investors.”

Advyzon data is unique in that it’s not a survey. Other surveys of advisor investments tend to rely on self-reporting, which can create a self-selecting pool or lead subjects to filter what they share. For this report, Advyzon looked at how assets were allocated across all firms that run their data through Advyzon’s platform.

Our data also focuses specifically on how RIAs invest client assets. While Morningstar reports that mutual funds are still winning—with 77% of global long-term assets in open-end mutual funds—those numbers look at the broadest possible swath of investments.

Morningstar did, however, spot the same trend when it comes to inflows and outflows. Their data showed $1.3 trillion flowing out of open-end mutual funds in 2022 while $754 billion flowed into ETFs.

According to Todd Rosenbluth, Head of Research at VettaFi and an expert in ETFs, “Advisors and investors are increasing turning to ETFs to get exposure to a wide range of investment styles. Relative to mutual funds, ETFs tend to be less expensive, more tax efficient, and provide more liquidity.”

He also highlighted a new trend to watch: “Many asset managers are bringing their best active strategies into the ETF world.” Whether that impacts how advisors think about individual securities going forward is something to watch for in next year’s data.

Stocks, bonds, and funds

We already saw a small decline in stock picking in 2022. Advisors held fewer individual stocks—22.4% of assets at the end of the year—than in 2021, when the number was 23.5%. While we can’t pinpoint the reasons for this shift, it’s likely advisors avoided the temptation to stock pick despite the market decline.

At the same time, more advisors invested in individual bonds. Advisors invested roughly 9% of client assets directly in fixed income at the end of the year, up from about 5% the previous year. It’s possible that advisors were trying to capture higher yield for clients without risking the price drop that comes with total return bond funds.

Morningstar data also mirrored this finding in the broader market: $483 billion flowed out of fixed-income funds in 2022, one of the worst years on record.

What this means going forward

Advyzon also pulled data for the first quarter of 2023 to assess how trends were evolving in the new year. So far, we’ve seen some of the enthusiasm for cash and cash equivalents decrease as yields on short-term investments fall. However, the still-inverted yield curve (as of July 2023) could mean cash allocations will hold steadily higher in the short term.

Given the rebound in equities this year, it’s likely we’ll see changes in those allocations, too. While mega-caps are once again outperforming this year, we’ve also seen layoffs at huge corporations, contributing to overall concerns about recession and the health of the economy. Additionally, growth stocks outperformed value stocks once again in the first half of the year.

Ultimately, however, all of the trends we’ve observed in 2022 and the start of 2023 may depend on the Fed. Whether you’re buying individual bonds or shifting money out of value stock ETFs into growth-focused funds, performance is likely to depend on what the Fed does with interest rates in the second half of the year.

For more information on how your fellow advisors are invested, download our full white paper: The New Diversification: Asset Allocation Into 2023.

If you prefer more up-to-date assessments of market performance, consider subscribing to the monthly market update from AIM CIO Brian Huckstep.