Data from Advyzon’s 1,000+ advisors in 2022 shows that in the ongoing debate over the best way to bill clients, there may not be one right answer. To conduct our latest white paper, we looked at any Advyzon firms that use our platform for billing. From there, we looked at their fee schedules. One thing we noticed off the bat? The number of options on the table increased this year. We’ll go over some of the highlights here. Advyzon users can download the full white paper on our Knowledge Base and nonusers can enter their email to receive a copy.

More advisors offering a flat-fee option

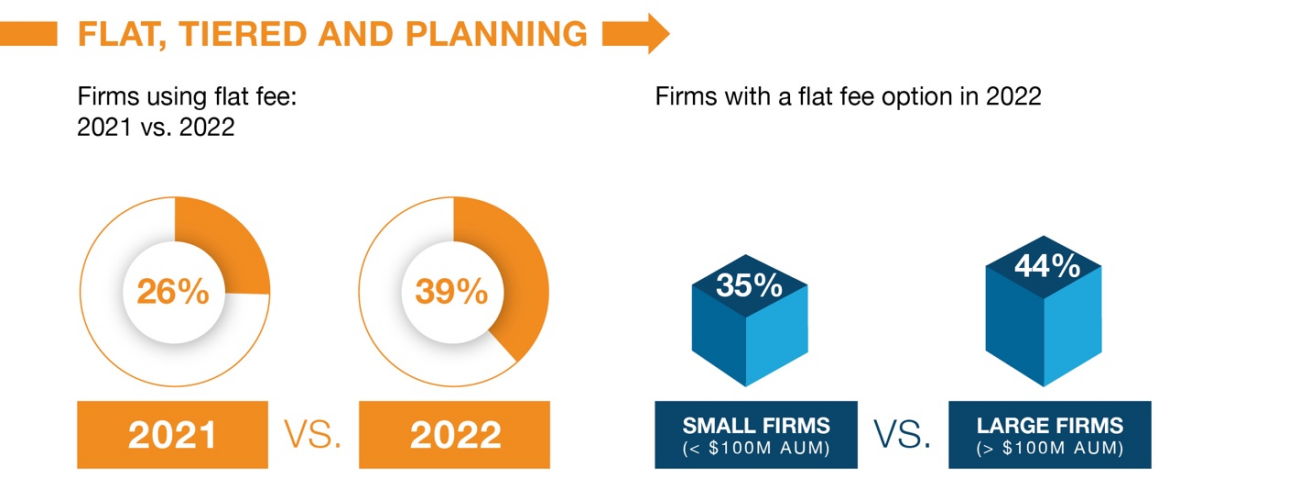

In 2021, our headline was that one in four advisors was offering some form of flat-fee option (usually a set dollar amount versus a percent AUM). In 2022, that number jumped from 26% to 39%.

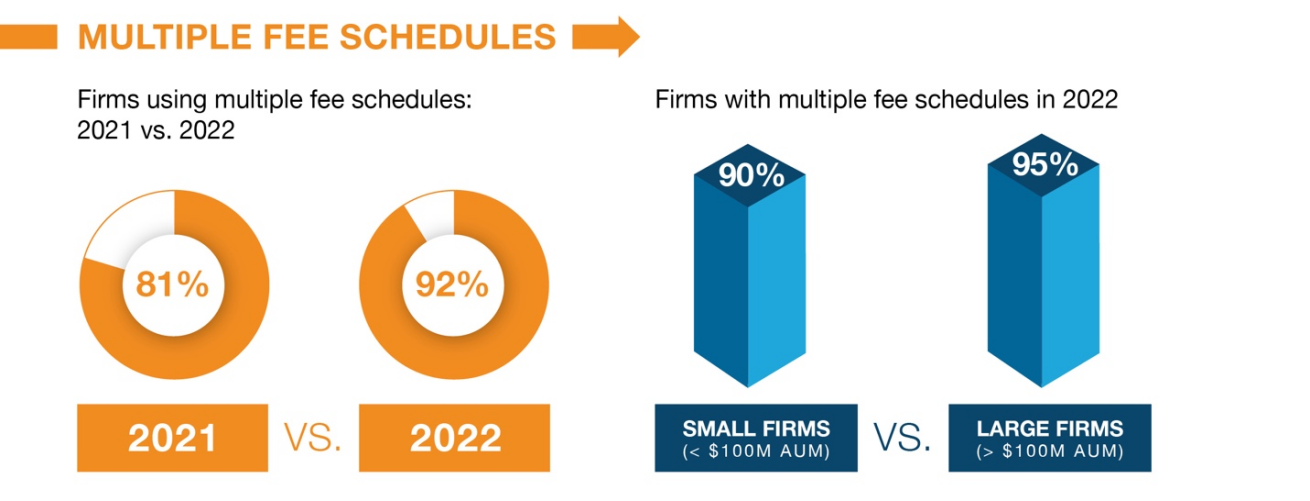

Of course, many of the firms offering a flat-fee option also offer tiered AUM. The vast majority of Advyzon firms (92%) use multiple fee schedules.

Flat fee offerings weren’t the only offering to increase this year. The number of firms offering monthly billing increased, but so did the number of firms with quarterly options. This suggests that firms are offering clients (and individual advisors) more flexibility in terms of payment.

Think about what makes sense for clients

One thing to consider: If you’re adding a flat fee option, what is your goal? Do you want to work with those clients on a one-time basis or try and leverage a planning fee into ongoing engagement work?

We asked Trailhead Advisors’ co-founder Courtney Ranstrom about this, as her firm offers both a one-time planning fee option as well as ongoing services via AUM billing. For her, the project-based model can help prospects who aren’t sure about working with a planner get a sense for the process. (The planning fee covers three separate meetings.) While this sometimes translates to an ongoing working relationship, it doesn’t always.

When it came to building their overall fee model, Trailhead aimed to simplify where possible. “Ideally, an RIA has a fee structure that doesn’t need much customization [for individual clients],” she says, before noting that practically speaking, customization may be required.

To figure out your base-line structure, she recommends deciding whether you aim to compete on price or on value. Either way, it’s a good idea to be able to explain, comprehensively, what’s included in your fee and why you choose to bill a certain way. For instance, she points out that some states have regulations that discourage an hourly billing model, but clients may not be aware of those considerations.

What’s fair for 2023?

At the end of the day, the best billing strategy from a client perspective often comes down to transparency and fairness.

Advyzon Senior Vice President for Business Development Charles Rowlan thinks advisors can add value, and potentially win clients, in 2023 if they’re able to emphasize why their billing system is fair. One easy way to do that (and also improve cash flow and revenue)? Average daily balance.

With average daily balance, you bill clients based on the average of their account balance, calculated daily throughout the billing period. That means you (and they) will have a better, and fairer, sense of their rate than you might if you’re relying on what the market does at the start or end of your billing cycle.

“I don’t think there’s a fairer way to bill,” Rowlan says, “For either party. I mean: Taking a snapshot of an asset four times a year? It creates a situation where investors might even hope for the market to fall on whatever day you bill so they pay a smaller fee for the quarter.”

In the past, billing on average daily balance wasn’t realistic, but with technology like Advyzon, these calculations work the same as any other billing method.

To learn more and see a wide swath of data, including what percentage of firms are using best versus blended tier, quarterly versus monthly, and more, download the full white paper.